“Iron ore may be more integral to the global economy than any other commodity, except perhaps oil”. — Christopher LaFemina, mining analyst at Barclays Capital, as cited on The Financial Times website, Oct. 26, 2009 As the source of primary iron for the world’s iron industry and the global production of steel, iron ore is essential to the maintenance of a strong industrial base i This central need for iron ore is underscored by the resiliency of its global production rate during the economic downtown, which only declined by 4% in 2009. meanwhile, total exports that same year reached record levels, up by 8% on 2008.

The trend continued through 2010, with total exports exceeding 1 billion tonnes for the first time ever, and representing an increase of 12% over 2009 levels? Iron & Iron Ore Basics iron is a metallic element that composes about 5% of the Earth’s crust, and is referred to by the periodic table symbol Fe. The two main ores mined for iron are hematite, which contains 70% iron, and magnetite, which contains 72% iron.

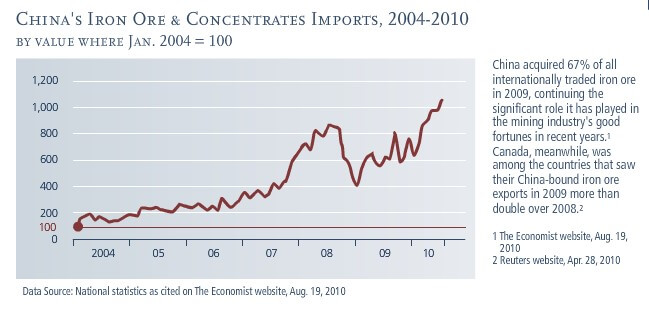

Hematite occurs in deposits that are mostly sedimentary in origin. The most important iron ore deposits today are banded iron formations (BIFs), which occur throughout the world. BIFs are made up of alternating layers of chert (a variety of silica), hematite and magnetite. Iron ore is smelted to form pig iron, which is one of the main raw materials in the steelmaking process.3 Resources, Production & Imports The U.S. Geological Survey (USGS) estimates global iron ore resources are greater than 800 billion metric tonnes of crude ore, containing over 230 billion tonnes of iron.4 While the U.S. is among the world’s largest iron ore producing nations — along with such countries as Russia, Brazil, China, Australia and India — the nation has imported more lower-cost foreign-made steel in recent years, with roughly half its imports coming from Canada.3 China Driving Market Imports China’s imports have played a significant role in the mining industry’s good fortunes in recent years.

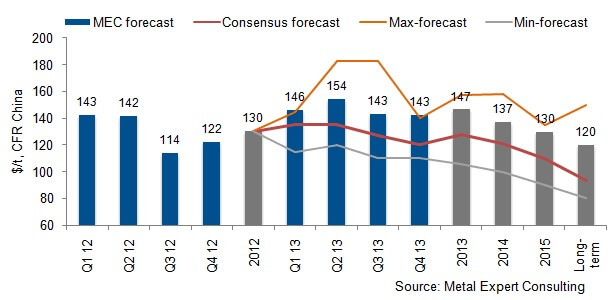

To support that nation’s rapidly growing infrastructure, China acquired 67% of all internationally traded iron ore in 2009,5 totaling 381 million tonnes (an increase of 41% over 2008).2 While Australia, Brazil and India have been the largest exporters to China since 1997, other countries, such as Canada, saw their China-bound iron ore exports in 2009 more than double over 2008.6 And in 2010, China’s imports only declined by 1% 2 The nation’s growing need for iron ore imports is driven both by ongoing economic development and falling production from its domestic mines.2 China’s domestic iron ore grade peaked at 50% iron content in 2003, and has been falling ever since, with recent levels averaging only about 20% iron (imported ore is usually 60% iron or greater).’ New Market Pricing Model Iron ore trading in the physical markets has been boosted by the abandonment in early 2010 of a 40-year-old benchmark pricing system. Instead of prices being set each year by annual contracts and lengthy price negotiations, the industry agreed to adopt prices based on quarterly contracts linked to the emerging iron ore spot market. The change effectively shifts the balance of pricing power in favor of miners.

To support that nation’s rapidly growing infrastructure, China acquired 67% of all internationally traded iron ore in 2009,5 totaling 381 million tonnes (an increase of 41% over 2008).2 While Australia, Brazil and India have been the largest exporters to China since 1997, other countries, such as Canada, saw their China-bound iron ore exports in 2009 more than double over 2008.6 And in 2010, China’s imports only declined by 1% 2 The nation’s growing need for iron ore imports is driven both by ongoing economic development and falling production from its domestic mines.2 China’s domestic iron ore grade peaked at 50% iron content in 2003, and has been falling ever since, with recent levels averaging only about 20% iron (imported ore is usually 60% iron or greater).’ New Market Pricing Model Iron ore trading in the physical markets has been boosted by the abandonment in early 2010 of a 40-year-old benchmark pricing system. Instead of prices being set each year by annual contracts and lengthy price negotiations, the industry agreed to adopt prices based on quarterly contracts linked to the emerging iron ore spot market. The change effectively shifts the balance of pricing power in favor of miners.

Instead of prices being set each year by annual contracts and lengthy price negotiations, the industry agreed to adopt prices based on quarterly contracts linked to the emerging iron ore spot market. The change effectively shifts the balance of pricing power in favor of miners. At the same time, analysts also predict the iron ore swaps market could grow from its current 5300 million to 5200 billion by 2020 if it mirrors the success of the thermal coal swaps market. Such a derivatives market would enable producers and consumers to more easily minimize their exposure to price risks through hedge positions in the physical commodities markets