Titanium is the fourth most abundant metallic element in the Earth’s crust, and though it is commonly associated with ‘titanium’ metal, only about 5% of all titanic mined is used to manufacture metal. The remaining 95% is used to manufacture titanium dioxide (Ti02), the industry leading pigment for adding whiteness, light refraction (i.e., brightness) and opacity to such products as paints, plastics, paper and inksi .

Titanium and Metal Titanium boasts the highest strength-to-weight ratio of any current structural metal. When alloyed, titanium is as strong as steel while having a specific gravity of only 56% of steel and half that of copper and nickel alloys, making it ideal-for use in everything from the aerospace industry — titanium’s historically largest user — to golf clubs. Titanium also has natural corrosion resistance, excellent flexibility, strong spring back characteristics, and is the most biocompatible of all metals, making it ideal for surgical implants. Current consumer goods applications include everything from jewelry to wrist watches, eyeglass frames, wedding rings, camera bodies, loudspeakers and non-stick coatings.

The automotive and motorcycle industries are also actively using and exploring new uses for titanium metals. Whether aiming to increase fuel economy, lower emissions, or lengthen warranties, manufacturers are considering titanium as a ‘value engineering’ solution for springs, exhaust systems and brake pads. Current applications include use in a Corvette muffler and in springs on a VW model.i Titanium and Pigments Titanium dioxide (Ti02) represents a SI 0 billion pigmentation industry,2 and the most important material used for whiteness and opacity in the paints and plastics industries. The unique demand for titanium dioxide stems from the pigment’s ability to bend and scatter light (i.e., its refractive index) being better than any other material, including diamond. Titanium dioxide also gives paint greater ‘hiding power’ (i.e., ability to mask or hide a substrate) than any other pigment3 while giving coatings, paper laminate and plastic items increased durability.

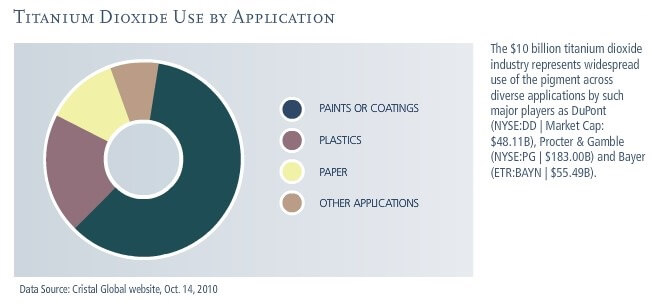

The pigment’s industrial and commercial applications range from paint and coatings (60%) to plastics (20%), paper (12%), and other applications (8%),4 such as Procter & Gamble (NYSE:PG I Market Cap: 5183.00B) using titanium dioxide for light refraction in sunscreens,s or Bayer (ETR:BAYN I 555.4913) using the pigment for whiteness in pill-based products such as Alleve.6 Supply & Production Over 4 million metric tons of titanium dioxide is produced worldwide annua Ily4 with roughly 90% coming from ilmenite deposits (titanium-iron oxide or TiFe0a, usually associated with iron), and the remainder from rutile deposits (titanium dioxide or Ti02).

According to the U.S. Geological Survey (USGS), Canada represents the eighth largest reserves of titaniun dioxide with 31 million metric tons. In 2010, Canada was the third highest producer of the pigment with 700,000 metric tons (12.1% of global production that year).7 In particular, Rio Tinto’s (NYSE:RIO) open-pit Fer et Titane mine (also known as lac Allard or Lac Tio mine) in Quebec, Canada, is the site of the world’s largest solid ilmenite deposit, Owing to the magnitude of the ilmenite deposit, the mine has a projected life of at least another 50 years, and currently employs close to 300 workers.

Demand & Price Forecast As with iron ore, the central need for pigments — and specifically titanium dioxide — is underscored by the resiliency of the estimated global demand during the economic downtown, whidi was only 3% lower in 2009 than the previous year. Meanwhile, pigment demand in the dominant Asia-Pacific market is projected to increase from 1.79 million metric tons in 2009 to 2.54 million tons by 2015, for a CAGR of 5.9%9 In the case of DuPont (NYSE:DD I Market Cap: $48.11 B), a 32% increase in quarterly demand from emerging markets alone delivered double-digit titanim dioxide sales increases that “far exceeded pre-recession levels.”10 Looking even further forward, weighted average global pigment prices are projected to continue to increase in nominal U.S. dollar terms at approximately 3.7% CAGR to 2015