“Global steel demand is expected to rise by 5.3% in 2011 according to the World Steel Association, i.e., 9.6% higher than the pre-crisis peak of 2007, implying a further nse in steel output.” — OECD website

With steel representing nearly 95% of all metal used each year,2 it’s understandable that the OECD’s Steel Committee points to upward movement in steel demand, production and prices following 2008 and 2009, which marked the worst slowdown in more than half a century. Government stimulus programs and the rebuilding of inventories in some economies have combined to support the recovery, which began around mid-2009. As of Q3 2010, steel mills worldwide had already ramped back up to roughly 80% of capacity (they had been running below 60% at the end of 2008).i And by the end of 2010, all the major steel-producing countries and regions had showed double-digit growth that amounted to total annual global crude steel production of 1,414 million tonnes, an increase of 150/0 over 2009, and a new record for world crude steel production.3

Production, Demand & Prices

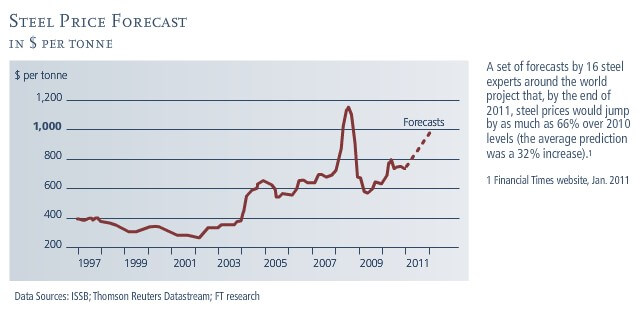

Despite the global recession, worldwide crude steel production declined only 7% in 2009 to 1,230 million tonnes:* And by July 2010, global steel production had relined to the same level as in autumn 2008 on the strength of growing demand,’ By the end of 2010, global steel production had reached 1,412 million tonnes, up 15% from 2009 and 5% higher than the previous peak reached in 2007.4 According to the OECD, growing demand has helped lift the average price of steel in every world region since mid-2009. And in some regions, prices have already increased to levels last seen in 2007 and early 2008.’ Meanwhile, a set of forecasts provided for the Financial Times by 16 steel experts around the world project that, by the end of 2011, steel prices would jump by as much as 66% over 2010 levels (the average prediction was a 32% increase).

Emerging Markets Leading Recovery

While North American and European steel demand fundamentals are improving, the markers recovery is being led by emerging markets in Asia through the support of government stimulus spending on infrastructue and a rebound in manufacturing activity.’ By Q2 2010, the OECD Steel Committee had reported that Asia’s then current steel demand was already 13% higher than pre-crisis levels, having begun its recovery as early as spring of 2009.6 Not surprisingly, the world’s biggest steel importing nation was China in 2009 (with imports 43% higher than in 2008) and South Korea in 2010 (with imports 22% higher than in 200g).4 Still, the OECD expects significant changes in future global steel production, consumption and capacity where emerging economies other than China will have significant influence. in the case of India, the country demonstrated strong growth in 2009 despite the global slowdown.

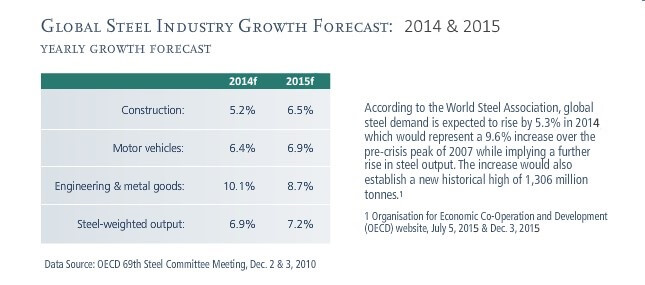

Steel Market Forecast According to the World Steel Association, global steel demand is expected to rise by 5.3% in 2014, which would represent a 9.6% increase over the pre-crisis peak of 2007 while implying a further rise in steel output. The increase would also establish a new historical high of 1,306 million tonnes. OS economies would experience the highest growth rates (11.1%), followed by the Americas (9%) and Europe (5.7%). Steel demand in Asia would grow by 4.1% in 2014, with higher growth rates for India (13.5%) and South-East Asia (7.4%) in particular while steel demand in China would increase by 3.5%.1